The Roadmap to Get You There

Our Business Insights Report is the culmination of a 360-degree analysis of your business. Upon completion, it becomes a roadmap to follow on your journey to improve the weak areas and enhance the strong ones. Ultimately making your business more ready and valuable to a buyer.

THE INFORMATION YOU NEED TO MAKE SMART DECISIONS

What’s Inside our Business Insights Report?

Our Business Insights Report provides you with a comprehensive, data-driven analysis to help you identify your value gaps.

Financial Analysis & Scorecard

Cashflow

Analysis

Credit

Assessment

Non-Financial KPI Review

Value Potential Established

Exit Strategy Readiness

Risk & Threat Assessment

Profit Gap

Analysis

Breakeven

Analysis

Sustainable Growth Analysis

Environmental, Social and Governance

Industry Benchmarking Analysis

ADD CLARITY TO YOUR MISSION

Track Progress & See Real-Time Results

Powerful software that increases visibility & collaboration

ADD CLARITY TO YOUR MISSION

Track Progress & See Real-Time Results

Powerful software that increases visibility & collaboration

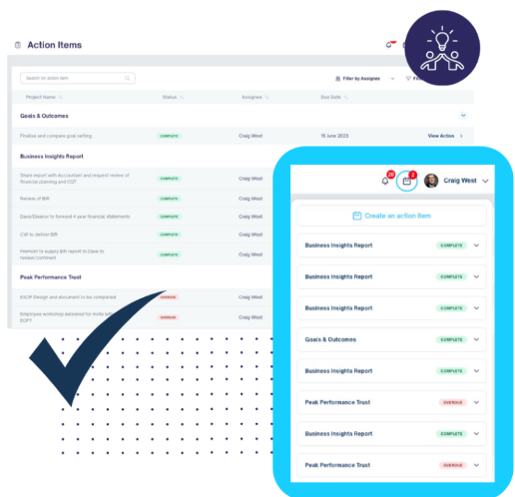

When you engage us to complete a Business Insights Report, you’ll be given access to our feature rich software platform to track your progress for 6 months. Features include:

- Interactive Dashboard

- Advanced Analytics & Valuation Tools

- Complete Planning Flexibility

- Real-Time Updates

- Analysis by Department

You’ll find our software to be an invaluable tool to help you accelerate the value of your business.

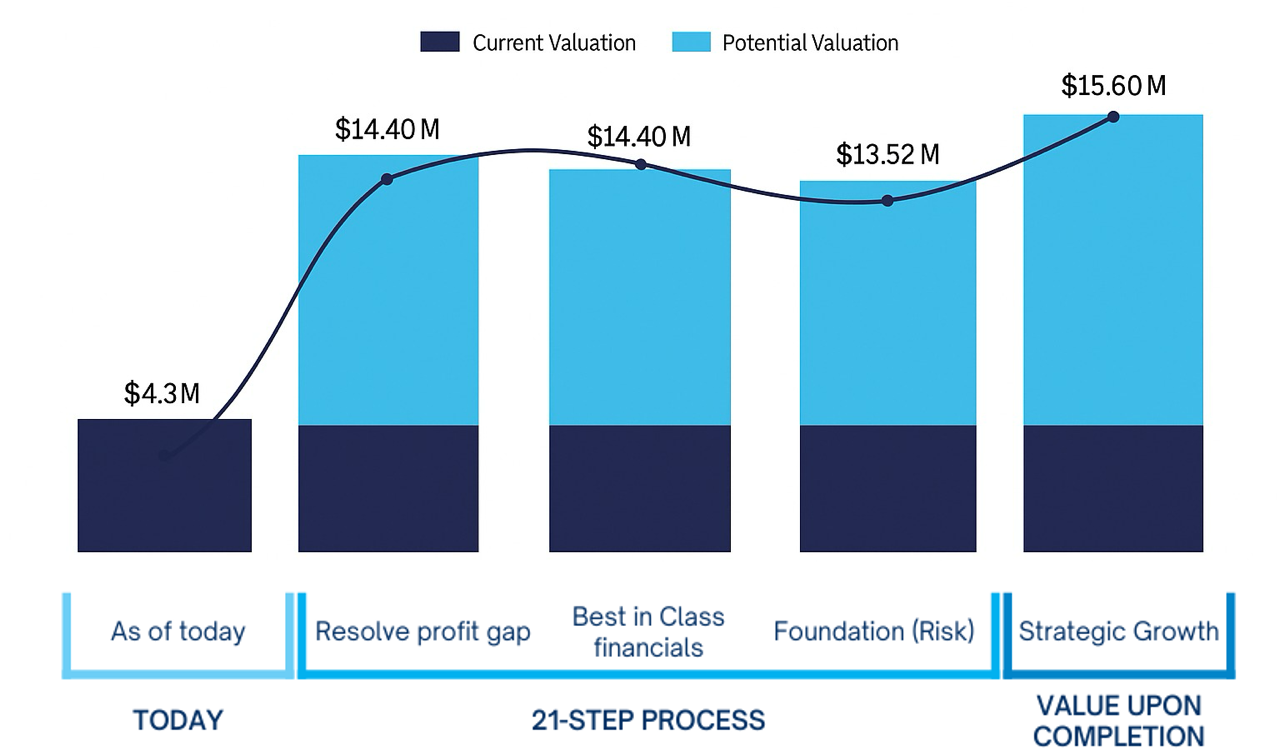

How We Determine Your Business Value

We primality use the income approach to determine the value of a business. This approach converts anticipated economic benefits into a present single amount. Simply put, the value of a business is directly related to the present value of all future cash flows that the business is reasonably expected to produce. The income approach requires estimates of future cash flows and an appropriate rate at which to discount those future cash flows.

Our analysis is backed by millions of data points that incorporate market dynamics, industry benchmarks, and factors unique to your business. We also utilize global information services like IBIS World to further support our valuations.

CURRENT VALUE IS A STARTING POINT TO BUILD ON

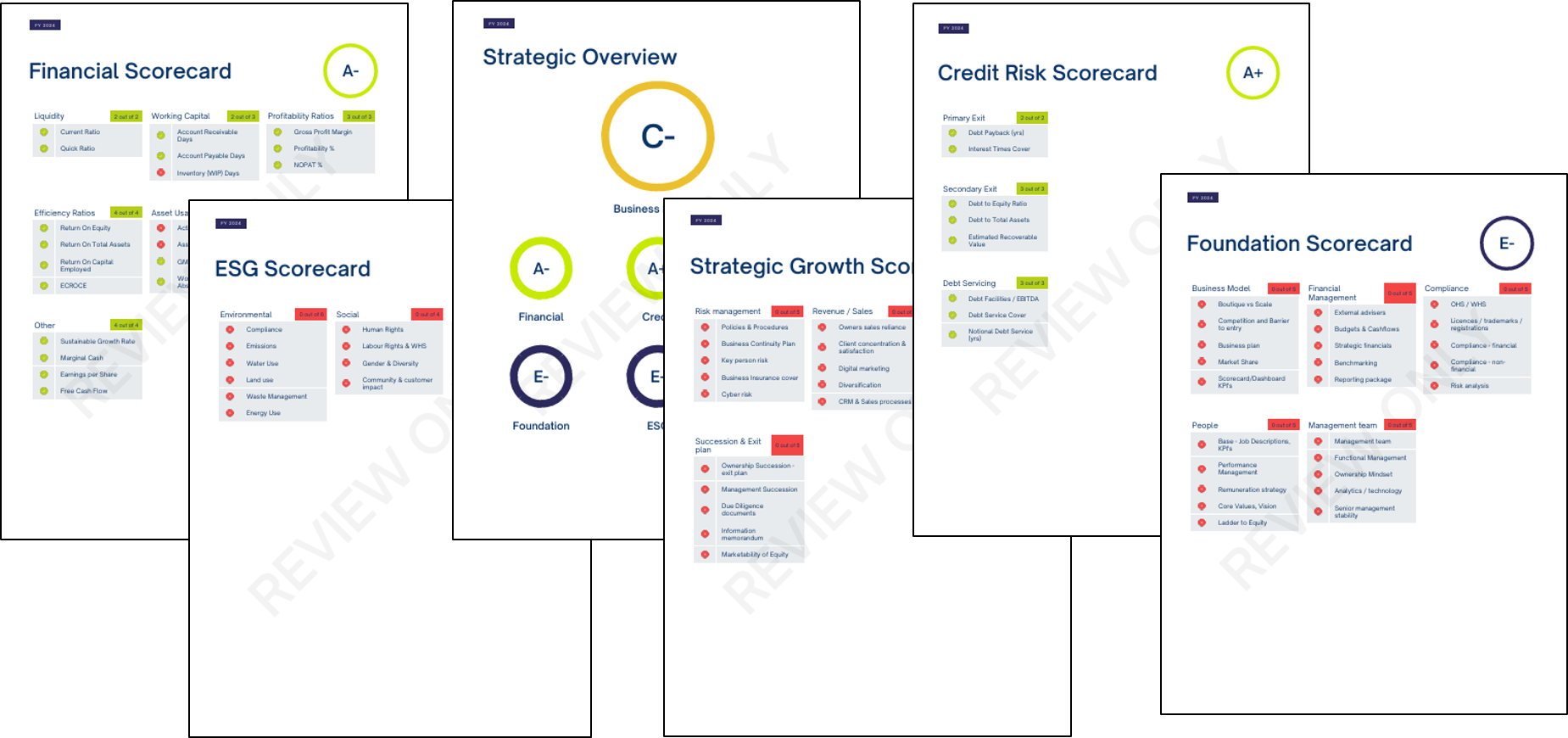

Scorecards

Our scorecards provide a quick reference on the health and progress of every area of your business. Our software provides real time updates so information can be gathered, shared and reviewed by members of your team and ours.

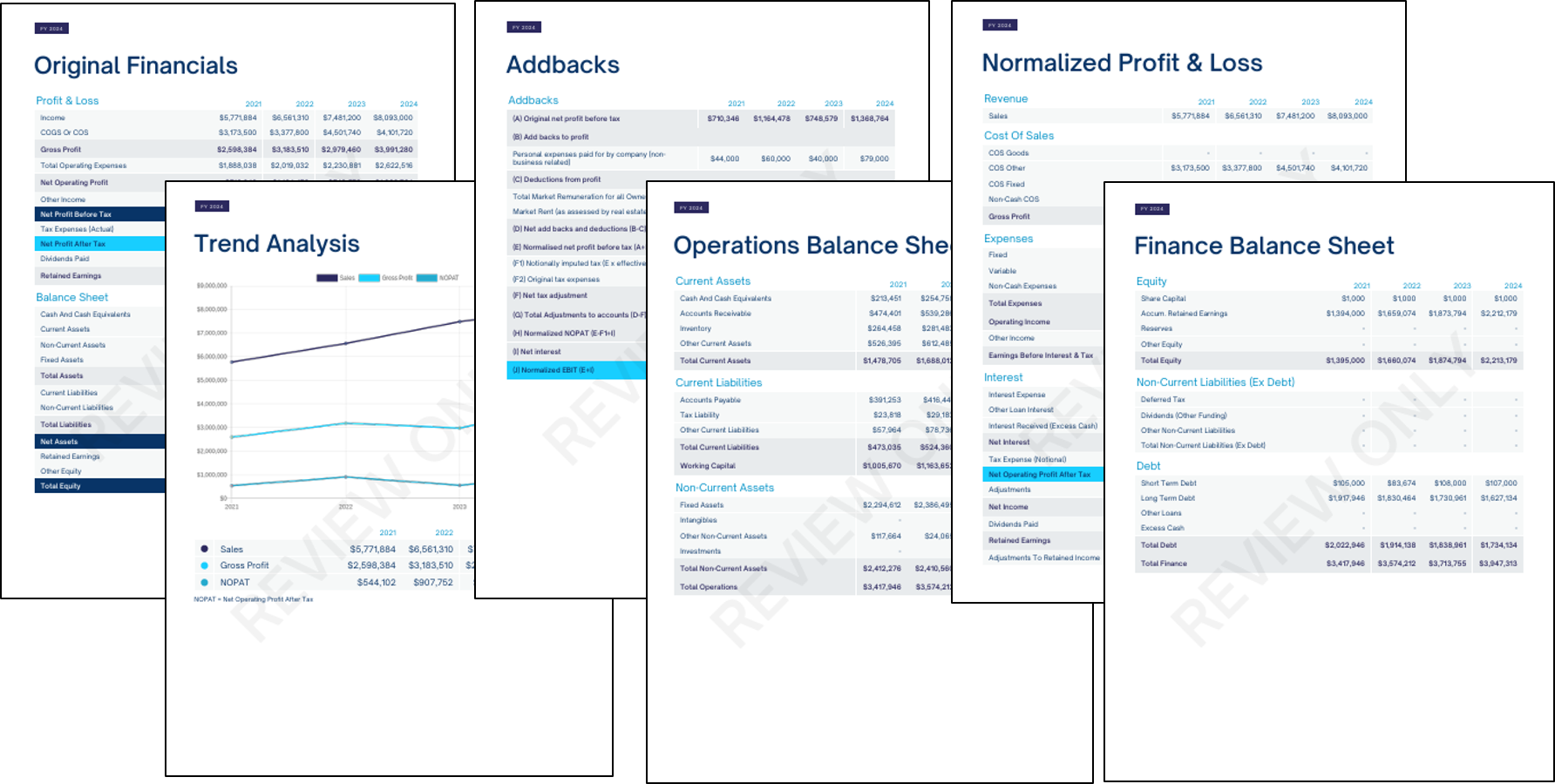

Financial Analysis

This section of the report provides you with a detailed analysis of your financials dating back up to 6 years. Our software can link directly to your accounting software and make information gathering a breeze.

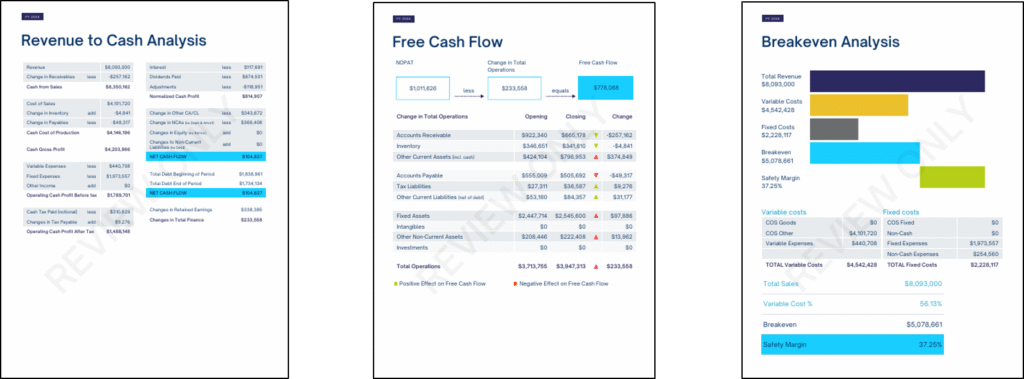

Cash Flow & Breakeven Analysis

Free cash flow (FCF) represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets. By analyzing free cash flow, revenue to cash, and breakeven points, we uncover new insights & opportunities for growth.

Benchmarking Analysis

Benchmarking provides a way to compare the company’s performance to its peers. By benchmarking its performance, the company can identify areas for improvement and implement best practices, which can increase the valuation of the business.

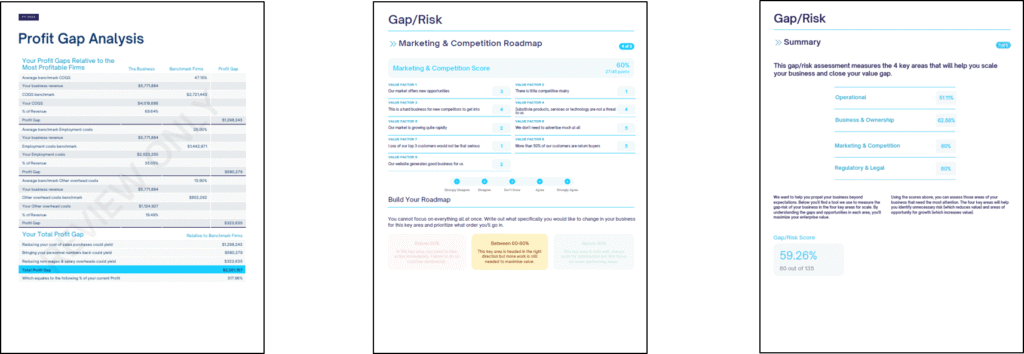

Gap Analysis

We identify gaps in four key areas that impact your ability to scale and increase value. You can then prioritize addressing the most underperforming areas first.

Non-Financial KPI Results

Non-financial aspects of a business are often neglected in terms of business evaluation. Still, they have an essential role as many speak to the business’s risk and attractiveness to a buyer, lender or investor. This ultimately has a significant impact on value.

Sustainable Growth & Credit Risk

Sustainable growth identifies how much a business can grow without changing the way it does business and without changing the debt : equity ratio. Credit risk ratios are a snapshot of a company’s resiliency at a given point in time.

Get Started

1. Schedule a Call

Schedule an introductory call with one of our certified exit planners using the link below. We’ll walk you through the process in detail and answer any questions you may have.

2. Purchase the Report

We will then work with you to gather the required information to complete the report.

3. Get Your Results + In-depth Review & Analysis with our Team

Once we have assembled all the required information, our team will complete the report and send you a copy. We’ll then schedule a number of virtual meetings with you to review and analyze the findings and decide on next steps.